Read more...

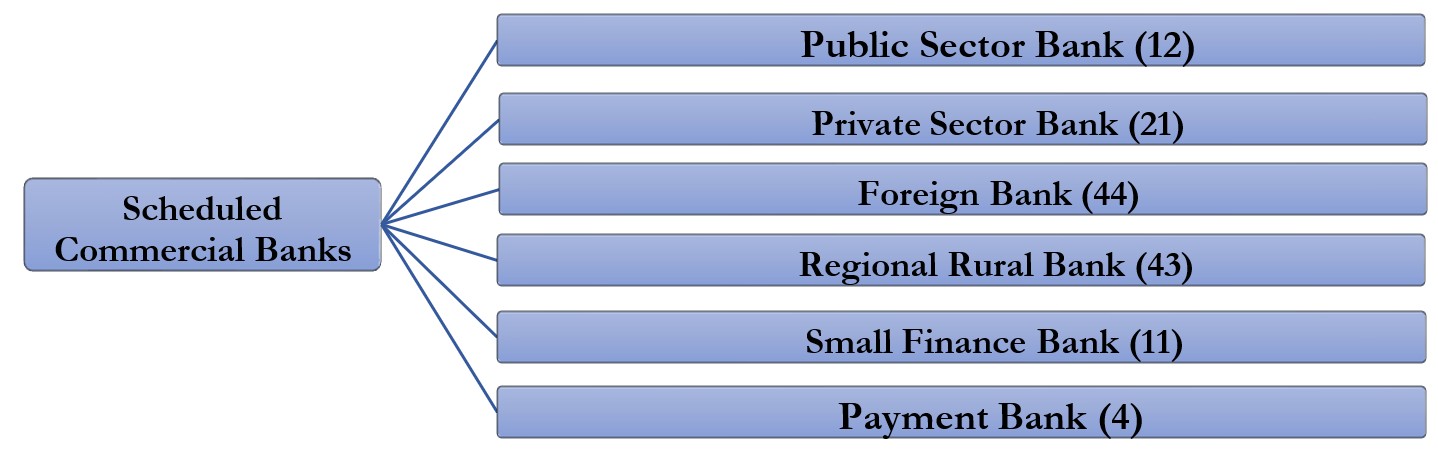

i. Scheduled Commercial Banks—

Scheduled Commercial banks includes public sector, private sector, foreign banks, Regional Rural Banks, Small Finance Banks and Payment Banks.

• Public Sector Banks: State Bank of India and 11 Nationalised Banks are established under the State Bank of India Act, 1955 and Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970/1980, respectively.

• Foreign Bank is a bank that has its headquarters outside the India but runs its offices as a private entity at any other locations in India. Such banks are under an obligation to operate under the regulations provided by RBI as well as the rule prescribed by the parent organization located outside India.

• Private Sector Banks are banking companies licensed to operate under Banking Regulation Act, 1949.

• Regional Rural Banks (RRB) are the banks established under the Regional Rural Banks Act, 1976 with the aim of ensuring sufficient institutional credit for agriculture and other rural sectors. The area of operation of RRBs is limited to the area notified by the Central Government. RRBs are owned jointly by the Government of India, the State Government and Sponsor Banks.

• Small Finance Banks licensed under Banking Regulation Act, 1949 and created with an objective of furthering financial inclusion by primarily undertaking basic banking activities to un-served and underserved sections including small business units, small and marginal farmers, micro and small enterprises and other underserved sections.

• Payment Banks are public limited companies licensed under Banking Regulation Act, 1949, with specific licensing conditions restricting its activities mainly to acceptance of demand deposits and provision of payments and remittance services.

ii. Foreign Direct Investment (FDI) in banking sector—

Within the banking sector, Foreign Direct Investment (FDI) in private sector banks is permitted up to 49% through automatic route, and beyond that up to 74% though government approval route. FDI in public sector banks is permitted up to 20% through government approval route.

iii. Non-Banking Financial Companies (NBFCs)—

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 2013 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority, etc. and regulated by RBI.

NBFCs is playing an important role in sustaining consumption demand as well as capital formation in small and medium industrial segment of the country. The reach and last mile advantages of NBFCs have empowered them with agility and innovation with cutting edge technology in providing formal financial services to underbanked and unserved sections of the society.

NBFCs can be classified on the basis of—

(a) Liability structures: NBFCs are subdivided into deposit-taking NBFCs (NBFC-D) - which accept and hold public deposits, and non-deposit taking NBFCs (NBFC-ND) - which source their funding from banks and markets.

(b) Activities undertaken: NBFCs are classified into 12 categories viz., Investment and Credit Company (ICC), Housing Finance Company (HFC), Micro Finance Institution (MFI), Infrastructure Finance Company (IFC), Infrastructure Debt Fund (IDF), Core Investment Company (CIC), Factor, Mortgage Guarantee Company (MGC), Standalone Primary Dealer (SPD), Non-Operative Financial Holding Company (NOFHC), Peer to Peer Lending Platform (P2P) and Account Aggregator (AA). ICC is the most prevalent category among them.

(c) Systemic significance: NBFCs were previously classified as

systemically important i.e., NBFC-ND with asset size of ₹500 crore & above and all deposit taking NBFCs (irrespective of asset size).

(d) Scale-Based Regulatory (SBR) Framework: RBI has introduced an SBR Framework for NBFCs w.e.f. 1.10.2022. The Framework categorizes the NBFCs in four layers based on their size, activity, and perceived riskiness:

- NBFC-Base Layer (NBFC-BL) - comprises of non-deposit taking NBFCs below the asset size of ₹1000 crore.

- NBFC-Middle Layer (NBFC-ML) - comprises of all non-deposit taking NBFCs with asset size of ₹1000 crore & above, and all deposit taking NBFCs (even those lower than ₹1000 crore).

- NBFC-Upper Layer (NBFC-UL) - Upper Layer comprises of NBFCs which are specifically identified by the RBI as warranting enhanced regulatory requirement based on a set of parameters and scoring methodology as per the SBR Framework. The top ten eligible NBFCs in terms of their asset size always reside in the Upper Layer, irrespective of any other factor. Further, some NBFCs identified on parametric analysis having systemic interconnectedness would also be included here.

- NBFC-Top Layer (NBFC-TL) - Top Layer shall ideally remain empty. This layer can get populated if the Reserve Bank is of the opinion that there is a substantial increase in the potential systemic risk from specific NBFCs in the Upper Layer. Such NBFCs shall move to the Top Layer from the Upper Layer.

Key Performance Parameters of Scheduled Commercial Banks and Public Sector Banks

(amount in ₹ lakh crore)

|

Mar-24 |

Sep-24 |

||

|

Advances |

PSBs |

97.73 |

102.29 |

|

SCBs |

175.09 |

182.96 |

|

|

Deposits |

PSBs |

128.97 |

133.75 |

|

SCBs |

217.17 |

226.60 |

|

|

GNPA (Amount & %) |

PSBs |

3.40 |

3.16 |

|

3.47% |

3.09% |

||

|

SCBs |

4.81 |

4.64 |

|

|

2.75% |

2.54% |

||

|

NNPA (Amount & %) |

PSBs |

0.73 |

0.63 |

|

0.76% |

0.63% |

||

|

SCBs |

1.07 |

1.01 |

|

|

0.62% |

0.57% |

||

|

PCR |

PSBs |

93% |

93.82% |

|

SCBs |

92.50% |

92.88% |

|

|

CRAR |

PSBs |

15.55% |

15.38% |

|

SCBs |

16.84% |

16.77% |

|

|

Net Profit |

PSBs |

1.41 |

0.86 (6months) |

|

SCBs |

3.50 |

1.99 (6months) |

Source: RBI Provisional data

II. Reforms in Banking Sector

i. Reforms undertaken in the banking sector

To identify and address the issue of stress in the banking system, RBI initiated Asset Quality Review (AQR) in 2015 under which, after transparent recognition by banks and withdrawal of the special treatment of restructured loans, stressed accounts were reclassified as NPAs and expected losses on stressed loans, not provided for earlier as a result of the special treatment, were provided for, resulting in higher NPAs which peaked in 2018. Higher NPA and necessitated provisioning deeply impacted the financial parameters of banks and impeded their ability to grow and lend to productive sectors of the economy.

Government’s commitment to reforms in the financial sector was announced at “Retreat for Banks and Financial Institutions” called “Gyan Sangam” held in 2015. Later in Aug-2015, Government launched “Indradhanush” scheme for comprehensive framework to revamp and improve financial state of PSBs including capital infusion plan over four years, from FY2015-16 to FY2018-19.

Government implemented a comprehensive 4R’s strategy of Recognising NPAs transparently, Resolution and Recovery, Recapitalising PSBs, and Reforms in the financial system to address the challenges faced by PSBs. The measures taken by the Government/RBI, include, inter alia, the following:

1. Credit discipline:

• The Insolvency and Bankruptcy Code (IBC) has laid down a collective mechanism for resolution of insolvencies in the country by maintaining a delicate balance for all stakeholders to preserve the economic value of the entities and to complete the process in a time bound manner. It has:

o Empowered creditors of a Corporate Debtor;

o Led to behavioural change in the debtor-creditor relationship by shifting the focus from the 'Debtor in Possession' to a ‘Creditor in Control’ regime.

• Setting up of the Central Repository of Information on Large Credits (CRILC) by RBI:

o To collects, stores and disseminates credit data to lenders; and

o Banks are required to submit report on weekly basis to CRILC, in case of any default by borrowing entities with exposure of ₹5 crore and above.

• Systematic checking of high-value accounts for wilful default and fraud.

2. Recognition and resolution of stress: To protect financial institutions in case of default or payment delay by large borrowers, RBI/Government has taken multiple steps which include, inter alia, the following:

• A comprehensive principle-based framework has been put in place for early recognition and time-bound resolution of stress in the borrower accounts, manifesting in payment default. Delayed resolution is disincentivised under the framework as lenders are required to make additional provisioning in case of resolution plans are not implemented within specified timeline.

• Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act) has been amended and it was provided for the District Magistrate / Chief Metropolitan Magistrate to pass orders for the purpose of taking possession of the secured assets by lenders within a period of thirty days from the date of application;

• The Recovery of Debts and Bankruptcy Act,1993 has been amended with the provision for three months imprisonment in case the borrower does not provide details of property/assets other than those properties/assets specified by the lender while filing the application to the DRT;

• Jurisdiction of Debt Recovery Tribunal (DRTs) was increased from ₹10 lakh to ₹20 lakh to enable the DRTs to focus on high value cases;

• To proactively detect stress and reduce slippage into NPAs, following measures have been implemented:

o Automated Early Warning Systems (EWS) in banks;

o Use of third-party data; and

o Workflow focussing on time-bound remedial actions.

• Regulatory framework for Asset Reconstruction Companies (ARCs) has been amended with an objective of:

o Strengthening transparency in the ARC sector; and

o Improving corporate governance standards in ARCs.

• Market based mechanisms have been strengthened to enable the financial institutions to better manage the credit risk on their balance sheets through a comprehensive framework for transfer of stressed assets to eligible transferees.

3. Financial Inclusion: Jan Dhan-led interventions and digital transformation have revolutionised financial inclusion in the country. By prioritizing access to financial services and providing safety nets for vulnerable populations, millions of individuals and families have been empowered, and it is fostering a more inclusive and secure society. Providing access to banking facilities, facilitating access to availability of credit, providing insurance and pension coverage and creating financial awareness to vulnerable sections of the society, the outcomes of the various Financial Inclusion schemes are far reaching and have a multiplier effect on the economy. The JAM (Jan-Dhan, Aadhaar, and Mobile) trinity has significantly advanced financial inclusion by incorporating millions of unbanked individuals into the formal banking system.

4. Enhanced Access & Service Excellence (EASE): Through EASE framework, an objective process of incremental reforms in sync with the evolving ecosystem has been institutionalised across PSBs. Areas of continued focus include – Governance, prudential lending, risk management, technology and data-driven banking and outcome-centric HR.

5. Governance in PSBs has been strengthened through:

• arm’s length selection of top management through FSIB;

• introduction of non-executive chairmen in nationalised banks;

• widening talent pool and instituting performance-based extensions for MD;

• instituting appraisal by Boards of top management and NODs;

• widening the pool of eligible WTDs by including private sector executives for appointment of MD & CEO in large PSBs; and

• recruitment of CXOs viz., Chief Risk Officer, Chief Compliance Officer, Chief Economist from the market.

6. With the amalgamation of banks, the efficacy of the banking sector has been enhanced by leveraging economies of scale and synergies. Amalgamation has enabled the amalgamated banks:

• to raise funds from the markets at a cheaper cost;

• greater financial capacity to support growth;

• to distribute risk and reduce the impact of region-specific economic downturns on the overall performance of the bank;

• to enhance service delivery and ability to invest in technology and innovation, and to better allocate resources; and

• to increase thrust on adoption of technology for efficient banking and cost optimization.

7. Maintaining general confidence level of bankers in taking prudent risks - To support decision-making and to prevent harassment for genuine commercial decisions by bankers, the Prevention of Corruption Act, 1988 has been amended to prohibit conduct of inquiry/investigation of offences relatable to decision taken by public servant in discharge of functions, without previous approval of the authority competent to remove him.

8. The setting up of National Asset Reconstruction Company Ltd. (NARCL) has enabled transfer of bad debts of the banks from their balance sheets to the former, and has also enabled freeing up human resources from recovery functions, for productive business development, including credit deployment.

ii. Impact of reforms

As a result of Government’s overarching policy response to recognition of stress, resolution of stressed accounts, recapitalisation and reforms in banks, the financial health and robustness of banking sector has improved significantly.

As per RBI’s provisional data and PSBs’ data:

(a) Asset quality has improved significantly with—

• Gross NPA ratio of SCBs declining to 2.54% (₹4.64 lakh crore) in Sep-24 from 4.28% (₹3.23 lakh crore) in Mar-15 and from a peak of 11.18% (₹10.36 lakh crore) in Mar-18.

• Gross NPA ratio of PSBs declining to 2.85% (₹3.03 lakh crore) in Dec-24 from 4.97% (₹2.79 lakh crore) in Mar-15 and from a peak of 14.58% (₹8.96 lakh crore) Mar-18.

• Net NPAs of SCBs declining to ₹1.01 lakh crore (0.57%) in Sep-24 from ₹2.31 lakh crore (3.13%) in Mar-15 and from a peak of ₹5.2 lakh crore (5.94%) in Mar-18.

• Net NPAs of PSBs declining to ₹0.61 lakh crore (0.59%) in Dec-24 from ₹2.15 lakh crore (3.92%) in Mar-15 and from a peak of ₹4.54 lakh crore (7.97%) in Mar-18.

(b) Resilience has increased with—

• Provision coverage ratio (PCR) of SCBs increasing from 49.31% in Mar-15 to a healthy 92.88% in Sep-24.

• PCR of PSBs increasing from 46.04% in Mar-15 to a healthy 93.87% in Dec-24.

(c) Capital adequacy has improved significantly with—

• CRAR of SCBs improving by 383 bps to reach 16.77% in Sep-24 from 12.94% in Mar-15.

• CRAR of PSBs improving by 338 bps to reach 14.83% in Sep-24 from 11.45% in Mar-15.

(d) During FY2023-24, SCBs have recorded highest ever aggregate net profit of ₹3.50 lakh crore against net profit of ₹2.63 lakh crore in FY2022-23, and recorded aggregate net profit of ₹1.99 lakh crore in the first half of FY2024-25.

In FY2023-24, PSBs have recorded highest ever aggregate net profit of ₹1.41 lakh crore against net profit of ₹1.05 lakh crore in FY2022-23, and recorded ₹1.29 lakh crore in the first nine months of FY2024-25.

(e) PSBs declared dividend of ₹27,830 crore to shareholders (GoI share ₹18,013 crore) in FY2023-24 against total dividend of ₹20,964 crore to shareholders (GoI share ₹13,804) in FY2022-23.

(f) Enabled by implementation of comprehensive reforms, the financial health of PSBs has improved significantly, enhancing their ability to raise capital (in the form of both equity and bonds) from the market. PSBs have mobilised capital of ₹4.34 lakh crore from the market from FY2014-15 to FY2023-24.

(g) Banks, earlier placed under Prompt Corrective Action (PCA) framework by RBI, have made significant improvement resulting in removal of each one of them from the PCA restrictions.

आगे पढ़ें...

i. Scheduled Commercial Banks—

Scheduled Commercial banks includes public sector, private sector, foreign banks, Regional Rural Banks, Small Finance Banks and Payment Banks.

• Public Sector Banks: State Bank of India and 11 Nationalised Banks are established under the State Bank of India Act, 1955 and Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970/1980, respectively.

• Foreign Bank is a bank that has its headquarters outside the India but runs its offices as a private entity at any other locations in India. Such banks are under an obligation to operate under the regulations provided by RBI as well as the rule prescribed by the parent organization located outside India.

• Private Sector Banks are banking companies licensed to operate under Banking Regulation Act, 1949.

• Regional Rural Banks (RRB) are the banks established under the Regional Rural Banks Act, 1976 with the aim of ensuring sufficient institutional credit for agriculture and other rural sectors. The area of operation of RRBs is limited to the area notified by the Central Government. RRBs are owned jointly by the Government of India, the State Government and Sponsor Banks.

• Small Finance Banks licensed under Banking Regulation Act, 1949 and created with an objective of furthering financial inclusion by primarily undertaking basic banking activities to un-served and underserved sections including small business units, small and marginal farmers, micro and small enterprises and other underserved sections.

• Payment Banks are public limited companies licensed under Banking Regulation Act, 1949, with specific licensing conditions restricting its activities mainly to acceptance of demand deposits and provision of payments and remittance services.

ii. Foreign Direct Investment (FDI) in banking sector—

Within the banking sector, Foreign Direct Investment (FDI) in private sector banks is permitted up to 49% through automatic route, and beyond that up to 74% though government approval route. FDI in public sector banks is permitted up to 20% through government approval route.

iii. Non-Banking Financial Companies (NBFCs)—

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 2013 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority, etc. and regulated by RBI.

NBFCs is playing an important role in sustaining consumption demand as well as capital formation in small and medium industrial segment of the country. The reach and last mile advantages of NBFCs have empowered them with agility and innovation with cutting edge technology in providing formal financial services to underbanked and unserved sections of the society.

NBFCs can be classified on the basis of—

(a) Liability structures: NBFCs are subdivided into deposit-taking NBFCs (NBFC-D) - which accept and hold public deposits, and non-deposit taking NBFCs (NBFC-ND) - which source their funding from banks and markets.

(b) Activities undertaken: NBFCs are classified into 12 categories viz., Investment and Credit Company (ICC), Housing Finance Company (HFC), Micro Finance Institution (MFI), Infrastructure Finance Company (IFC), Infrastructure Debt Fund (IDF), Core Investment Company (CIC), Factor, Mortgage Guarantee Company (MGC), Standalone Primary Dealer (SPD), Non-Operative Financial Holding Company (NOFHC), Peer to Peer Lending Platform (P2P) and Account Aggregator (AA). ICC is the most prevalent category among them.

(c) Systemic significance: NBFCs were previously classified as

systemically important i.e., NBFC-ND with asset size of ₹500 crore & above and all deposit taking NBFCs (irrespective of asset size).

(d) Scale-Based Regulatory (SBR) Framework: RBI has introduced an SBR Framework for NBFCs w.e.f. 1.10.2022. The Framework categorizes the NBFCs in four layers based on their size, activity, and perceived riskiness:

- NBFC-Base Layer (NBFC-BL) - comprises of non-deposit taking NBFCs below the asset size of ₹1000 crore.

- NBFC-Middle Layer (NBFC-ML) - comprises of all non-deposit taking NBFCs with asset size of ₹1000 crore & above, and all deposit taking NBFCs (even those lower than ₹1000 crore).

- NBFC-Upper Layer (NBFC-UL) - Upper Layer comprises of NBFCs which are specifically identified by the RBI as warranting enhanced regulatory requirement based on a set of parameters and scoring methodology as per the SBR Framework. The top ten eligible NBFCs in terms of their asset size always reside in the Upper Layer, irrespective of any other factor. Further, some NBFCs identified on parametric analysis having systemic interconnectedness would also be included here.

- NBFC-Top Layer (NBFC-TL) - Top Layer shall ideally remain empty. This layer can get populated if the Reserve Bank is of the opinion that there is a substantial increase in the potential systemic risk from specific NBFCs in the Upper Layer. Such NBFCs shall move to the Top Layer from the Upper Layer.

Key Performance Parameters of Scheduled Commercial Banks and Public Sector Banks

(amount in ₹ lakh crore)

|

Mar-24 |

Sep-24 |

||

|

Advances |

PSBs |

97.73 |

102.29 |

|

SCBs |

175.09 |

182.96 |

|

|

Deposits |

PSBs |

128.97 |

133.75 |

|

SCBs |

217.17 |

226.60 |

|

|

GNPA (Amount & %) |

PSBs |

3.40 |

3.16 |

|

3.47% |

3.09% |

||

|

SCBs |

4.81 |

4.64 |

|

|

2.75% |

2.54% |

||

|

NNPA (Amount & %) |

PSBs |

0.73 |

0.63 |

|

0.76% |

0.63% |

||

|

SCBs |

1.07 |

1.01 |

|

|

0.62% |

0.57% |

||

|

PCR |

PSBs |

93% |

93.82% |

|

SCBs |

92.50% |

92.88% |

|

|

CRAR |

PSBs |

15.55% |

15.38% |

|

SCBs |

16.84% |

16.77% |

|

|

Net Profit |

PSBs |

1.41 |

0.86 (6months) |

|

SCBs |

3.50 |

1.99 (6months) |

Source: RBI Provisional data

II. Reforms in Banking Sector

i. Reforms undertaken in the banking sector

To identify and address the issue of stress in the banking system, RBI initiated Asset Quality Review (AQR) in 2015 under which, after transparent recognition by banks and withdrawal of the special treatment of restructured loans, stressed accounts were reclassified as NPAs and expected losses on stressed loans, not provided for earlier as a result of the special treatment, were provided for, resulting in higher NPAs which peaked in 2018. Higher NPA and necessitated provisioning deeply impacted the financial parameters of banks and impeded their ability to grow and lend to productive sectors of the economy.

Government’s commitment to reforms in the financial sector was announced at “Retreat for Banks and Financial Institutions” called “Gyan Sangam” held in 2015. Later in Aug-2015, Government launched “Indradhanush” scheme for comprehensive framework to revamp and improve financial state of PSBs including capital infusion plan over four years, from FY2015-16 to FY2018-19.

Government implemented a comprehensive 4R’s strategy of Recognising NPAs transparently, Resolution and Recovery, Recapitalising PSBs, and Reforms in the financial system to address the challenges faced by PSBs. The measures taken by the Government/RBI, include, inter alia, the following:

1. Credit discipline:

• The Insolvency and Bankruptcy Code (IBC) has laid down a collective mechanism for resolution of insolvencies in the country by maintaining a delicate balance for all stakeholders to preserve the economic value of the entities and to complete the process in a time bound manner. It has:

o Empowered creditors of a Corporate Debtor;

o Led to behavioural change in the debtor-creditor relationship by shifting the focus from the 'Debtor in Possession' to a ‘Creditor in Control’ regime.

• Setting up of the Central Repository of Information on Large Credits (CRILC) by RBI:

o To collects, stores and disseminates credit data to lenders; and

o Banks are required to submit report on weekly basis to CRILC, in case of any default by borrowing entities with exposure of ₹5 crore and above.

• Systematic checking of high-value accounts for wilful default and fraud.

2. Recognition and resolution of stress: To protect financial institutions in case of default or payment delay by large borrowers, RBI/Government has taken multiple steps which include, inter alia, the following:

• A comprehensive principle-based framework has been put in place for early recognition and time-bound resolution of stress in the borrower accounts, manifesting in payment default. Delayed resolution is disincentivised under the framework as lenders are required to make additional provisioning in case of resolution plans are not implemented within specified timeline.

• Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act) has been amended and it was provided for the District Magistrate / Chief Metropolitan Magistrate to pass orders for the purpose of taking possession of the secured assets by lenders within a period of thirty days from the date of application;

• The Recovery of Debts and Bankruptcy Act,1993 has been amended with the provision for three months imprisonment in case the borrower does not provide details of property/assets other than those properties/assets specified by the lender while filing the application to the DRT;

• Jurisdiction of Debt Recovery Tribunal (DRTs) was increased from ₹10 lakh to ₹20 lakh to enable the DRTs to focus on high value cases;

• To proactively detect stress and reduce slippage into NPAs, following measures have been implemented:

o Automated Early Warning Systems (EWS) in banks;

o Use of third-party data; and

o Workflow focussing on time-bound remedial actions.

• Regulatory framework for Asset Reconstruction Companies (ARCs) has been amended with an objective of:

o Strengthening transparency in the ARC sector; and

o Improving corporate governance standards in ARCs.

• Market based mechanisms have been strengthened to enable the financial institutions to better manage the credit risk on their balance sheets through a comprehensive framework for transfer of stressed assets to eligible transferees.

3. Financial Inclusion: Jan Dhan-led interventions and digital transformation have revolutionised financial inclusion in the country. By prioritizing access to financial services and providing safety nets for vulnerable populations, millions of individuals and families have been empowered, and it is fostering a more inclusive and secure society. Providing access to banking facilities, facilitating access to availability of credit, providing insurance and pension coverage and creating financial awareness to vulnerable sections of the society, the outcomes of the various Financial Inclusion schemes are far reaching and have a multiplier effect on the economy. The JAM (Jan-Dhan, Aadhaar, and Mobile) trinity has significantly advanced financial inclusion by incorporating millions of unbanked individuals into the formal banking system.

4. Enhanced Access & Service Excellence (EASE): Through EASE framework, an objective process of incremental reforms in sync with the evolving ecosystem has been institutionalised across PSBs. Areas of continued focus include – Governance, prudential lending, risk management, technology and data-driven banking and outcome-centric HR.

5. Governance in PSBs has been strengthened through:

• arm’s length selection of top management through FSIB;

• introduction of non-executive chairmen in nationalised banks;

• widening talent pool and instituting performance-based extensions for MD;

• instituting appraisal by Boards of top management and NODs;

• widening the pool of eligible WTDs by including private sector executives for appointment of MD & CEO in large PSBs; and

• recruitment of CXOs viz., Chief Risk Officer, Chief Compliance Officer, Chief Economist from the market.

6. With the amalgamation of banks, the efficacy of the banking sector has been enhanced by leveraging economies of scale and synergies. Amalgamation has enabled the amalgamated banks:

• to raise funds from the markets at a cheaper cost;

• greater financial capacity to support growth;

• to distribute risk and reduce the impact of region-specific economic downturns on the overall performance of the bank;

• to enhance service delivery and ability to invest in technology and innovation, and to better allocate resources; and

• to increase thrust on adoption of technology for efficient banking and cost optimization.

7. Maintaining general confidence level of bankers in taking prudent risks - To support decision-making and to prevent harassment for genuine commercial decisions by bankers, the Prevention of Corruption Act, 1988 has been amended to prohibit conduct of inquiry/investigation of offences relatable to decision taken by public servant in discharge of functions, without previous approval of the authority competent to remove him.

8. The setting up of National Asset Reconstruction Company Ltd. (NARCL) has enabled transfer of bad debts of the banks from their balance sheets to the former, and has also enabled freeing up human resources from recovery functions, for productive business development, including credit deployment.

ii. Impact of reforms

As a result of Government’s overarching policy response to recognition of stress, resolution of stressed accounts, recapitalisation and reforms in banks, the financial health and robustness of banking sector has improved significantly.

As per RBI’s provisional data and PSBs’ data:

(a) Asset quality has improved significantly with—

• Gross NPA ratio of SCBs declining to 2.54% (₹4.64 lakh crore) in Sep-24 from 4.28% (₹3.23 lakh crore) in Mar-15 and from a peak of 11.18% (₹10.36 lakh crore) in Mar-18.

• Gross NPA ratio of PSBs declining to 2.85% (₹3.03 lakh crore) in Dec-24 from 4.97% (₹2.79 lakh crore) in Mar-15 and from a peak of 14.58% (₹8.96 lakh crore) Mar-18.

• Net NPAs of SCBs declining to ₹1.01 lakh crore (0.57%) in Sep-24 from ₹2.31 lakh crore (3.13%) in Mar-15 and from a peak of ₹5.2 lakh crore (5.94%) in Mar-18.

• Net NPAs of PSBs declining to ₹0.61 lakh crore (0.59%) in Dec-24 from ₹2.15 lakh crore (3.92%) in Mar-15 and from a peak of ₹4.54 lakh crore (7.97%) in Mar-18.

(b) Resilience has increased with—

• Provision coverage ratio (PCR) of SCBs increasing from 49.31% in Mar-15 to a healthy 92.88% in Sep-24.

• PCR of PSBs increasing from 46.04% in Mar-15 to a healthy 93.87% in Dec-24.

(c) Capital adequacy has improved significantly with—

• CRAR of SCBs improving by 383 bps to reach 16.77% in Sep-24 from 12.94% in Mar-15.

• CRAR of PSBs improving by 338 bps to reach 14.83% in Sep-24 from 11.45% in Mar-15.

(d) During FY2023-24, SCBs have recorded highest ever aggregate net profit of ₹3.50 lakh crore against net profit of ₹2.63 lakh crore in FY2022-23, and recorded aggregate net profit of ₹1.99 lakh crore in the first half of FY2024-25.

In FY2023-24, PSBs have recorded highest ever aggregate net profit of ₹1.41 lakh crore against net profit of ₹1.05 lakh crore in FY2022-23, and recorded ₹1.29 lakh crore in the first nine months of FY2024-25.

(e) PSBs declared dividend of ₹27,830 crore to shareholders (GoI share ₹18,013 crore) in FY2023-24 against total dividend of ₹20,964 crore to shareholders (GoI share ₹13,804) in FY2022-23.

(f) Enabled by implementation of comprehensive reforms, the financial health of PSBs has improved significantly, enhancing their ability to raise capital (in the form of both equity and bonds) from the market. PSBs have mobilised capital of ₹4.34 lakh crore from the market from FY2014-15 to FY2023-24.

(g) Banks, earlier placed under Prompt Corrective Action (PCA) framework by RBI, have made significant improvement resulting in removal of each one of them from the PCA restrictions.