Read more...

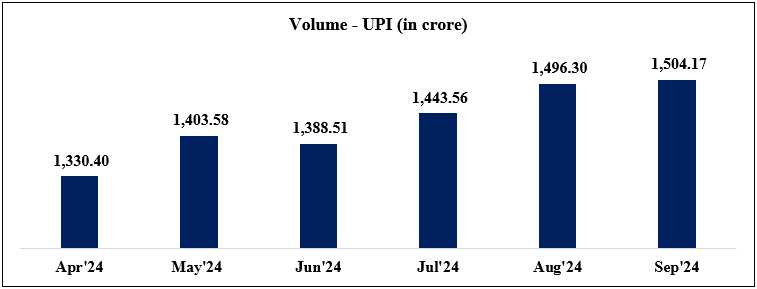

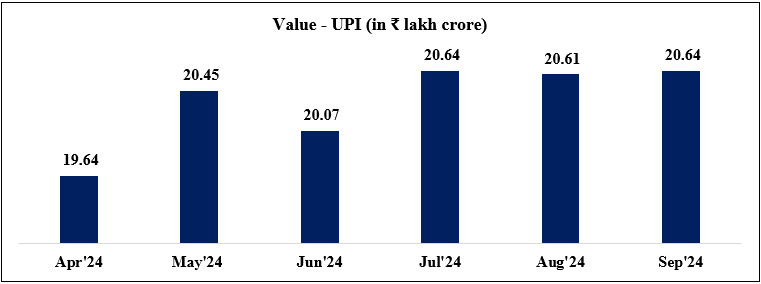

a. Month on Month UPI Transactions

|

|

Apr'24 |

May'24 |

Jun'24 |

Jul'24 |

Aug'24 |

Sep'24 |

|

Volume (in crore) |

1,330.40 |

1,403.58 |

1,388.51 |

1,443.56 |

1,496.30 |

1,504.17 |

|

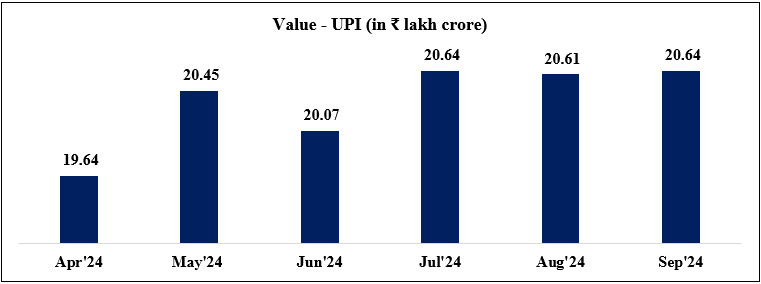

Value (in ₹ lakh crore) |

19.64 |

20.45 |

20.07 |

20.64 |

20.61 |

20.64 |

Source: NPCI

Source: NPCI

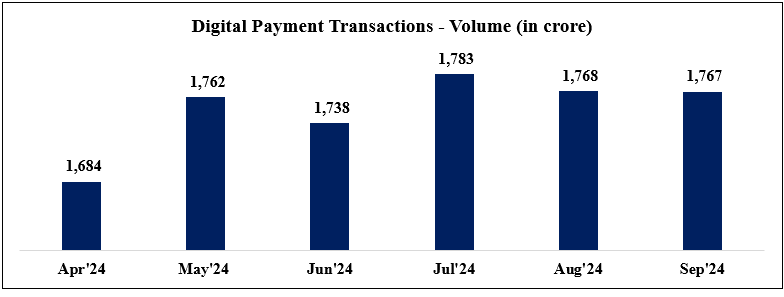

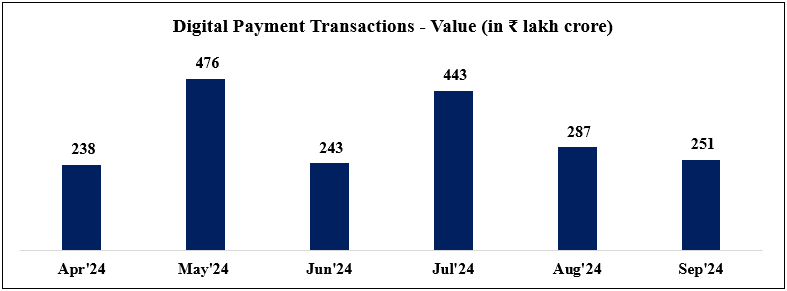

Digital Payments have significantly increased in recent years as a result of coordinated efforts of the Government with all stakeholders. The total digital payment transactions volume increased from 2,071 crore in FY 2017-18 to 18,737 crore in FY 2023-24 at CAGR of 44%.

Digital Payments include modes such as NACH, IMPS, UPI, AePS, NETC, Debit Card, Credit Card, NEFT, RTGS, Prepaid Payment Instruments, Internet Banking, Mobile Banking and Others (all intrabank transactions).

Source: RBI, NPCI & Banks

UPI has revolutionized digital payments in the country, UPI transactions have grown from 92 crore in FY 2017-18 to 13,116 crore in FY 2023-24 at CAGR of 129%. As per ACI Worldwide Report 2023, around 46% of the global real-time payment transactions is happening in India. UPI has been the major driving force in the overall growth of digital payment transactions in the country accounting for 70% of digital payment transactions in FY 2023-24. In May 2024, UPI reached another milestone recording over 1,403 crore transactions in a single month for the first time.

Source : NPCI

UPI transactions are bifurcated into two categories:

. P2P (Person-to-Person) Transactions involve transfer of funds between two individual users or individual accounts through UPI.

. P2M (Person-to-Merchant) Transactions involve payments through UPI made from an individual to merchants or service providers.

Source : NPCI

Internationalization of UPI & RuPay:

India’s indigenously developed UPI and RuPay cards are world class platforms for enabling digital payments. Government is making efforts to promote these products globally.

. At present UPI is fully functional and live in UAE, France, Bhutan, Sri Lanka, Nepal, Singapore and Mauritius

. RuPay cards acceptance is live in Nepal, Bhutan, Singapore, UAE, and Mauritius

आगे पढ़ें...

a. Month on Month UPI Transactions

|

|

Apr'24 |

May'24 |

Jun'24 |

Jul'24 |

Aug'24 |

Sep'24 |

|

Volume (in crore) |

1,330.40 |

1,403.58 |

1,388.51 |

1,443.56 |

1,496.30 |

1,504.17 |

|

Value (in ₹ lakh crore) |

19.64 |

20.45 |

20.07 |

20.64 |

20.61 |

20.64 |

Source: NPCI

Source: NPCI

Digital Payments have significantly increased in recent years as a result of coordinated efforts of the Government with all stakeholders. The total digital payment transactions volume increased from 2,071 crore in FY 2017-18 to 18,737 crore in FY 2023-24 at CAGR of 44%.

Digital Payments include modes such as NACH, IMPS, UPI, AePS, NETC, Debit Card, Credit Card, NEFT, RTGS, Prepaid Payment Instruments, Internet Banking, Mobile Banking and Others (all intrabank transactions).

Source: RBI, NPCI & Banks

UPI has revolutionized digital payments in the country, UPI transactions have grown from 92 crore in FY 2017-18 to 13,116 crore in FY 2023-24 at CAGR of 129%. As per ACI Worldwide Report 2023, around 46% of the global real-time payment transactions is happening in India. UPI has been the major driving force in the overall growth of digital payment transactions in the country accounting for 70% of digital payment transactions in FY 2023-24. In May 2024, UPI reached another milestone recording over 1,403 crore transactions in a single month for the first time.

Source : NPCI

UPI transactions are bifurcated into two categories:

. P2P (Person-to-Person) Transactions involve transfer of funds between two individual users or individual accounts through UPI.

. P2M (Person-to-Merchant) Transactions involve payments through UPI made from an individual to merchants or service providers.

Source : NPCI

Internationalization of UPI & RuPay:

India’s indigenously developed UPI and RuPay cards are world class platforms for enabling digital payments. Government is making efforts to promote these products globally.

. At present UPI is fully functional and live in UAE, France, Bhutan, Sri Lanka, Nepal, Singapore and Mauritius

. RuPay cards acceptance is live in Nepal, Bhutan, Singapore, UAE, and Mauritius